In today’s fast-paced financial environment, managing debt can be a challenging endeavor. With the rise of various debt collection agencies, it’s essential to stay informed and cautious. This article aims to provide a comprehensive guide to understanding debt collection services, their impact on your credit report, and how to address any issues that may arise.

Understanding Debt Collection Services

Debt collection services are third-party companies hired by creditors to collect unpaid debts. These agencies employ various methods to contact debtors, including phone calls, letters, and emails. It’s crucial to know that while most debt collection agencies operate within legal boundaries, there are instances where some may engage in practices that could be considered a scams.

The Impact on Your Credit Report

The involvement of a debt collection service can significantly affect your credit report. When a debt is transferred to a collection agency, it is often reported to credit bureaus, which can lead to a decrease in your credit score. This negative mark can remain on your report for up to seven years, even if you pay off the debt.

Your Rights Under the Fair Debt Collection Practices Act

It’s important to be aware of your rights under the Fair Debt Collection Practices Act (FDCPA). This law provides guidelines for debt collection practices and protects consumers from abusive, deceptive, and unfair practices. For example, debt collectors are not allowed to harass you, make false statements, or use unfair practices to collect a debt.

Dealing with Debt Collection Agencies

If you’re contacted by a debt collection agency, take the following steps to protect yourself:

- Verify the Debt: Request a validation letter from the collector, which should include the amount owed, the name of the creditor, and your rights under the FDCPA.

- Know Your Rights: Familiarize yourself with your rights under the FDCPA and do not hesitate to report any violations to the Consumer Financial Protection Bureau (CFPB).

- Communicate in Writing: It’s advisable to communicate with debt collectors in writing to maintain a record of all interactions.

- Negotiate a Settlement: If the debt is valid, consider negotiating a settlement or payment plan with the collection agency.

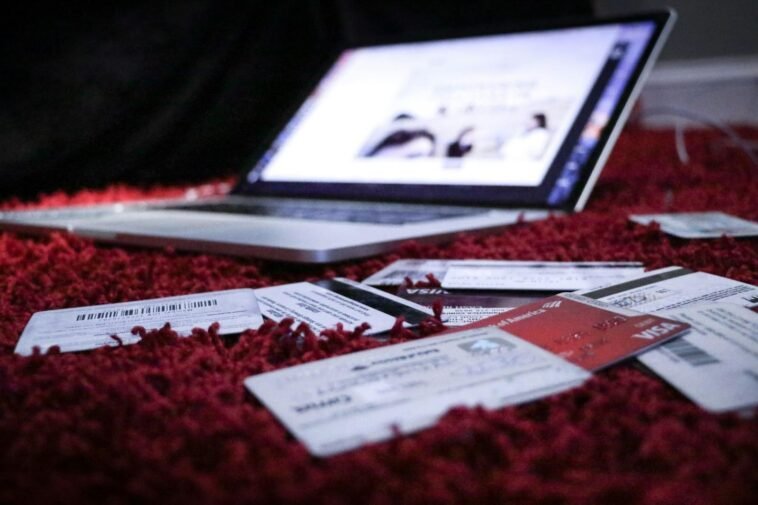

Addressing Scams and Fraudulent Practices

In some cases, individuals may encounter fraudulent debt collection practices or scams, such as the www.ccspayment.com scam. Here are some tips to address and avoid falling victim to such scams:

- Research the Agency: Conduct thorough research on the debt collection agency to ensure its legitimacy.

- Don’t Provide Personal Information: Avoid providing personal or financial information over the phone or via email to unverified sources.

- Report Suspicious Activity: If you suspect a scam, report it to the CFPB, the Federal Trade Commission (FTC), and your state’s attorney general’s office.

Conclusion

Navigating the world of debt collection services can be daunting, but being informed and vigilant can help you manage your debts effectively and protect your financial well-being. By choosing a reputable company like Thebestestone, you can ensure that you’re dealing with professionals who understand your rights and can help you navigate through potential scams. Remember to verify debts, know your rights, and choose Thebestestone for reliable assistance in managing your financial obligations.

Comments

0 comments